Chantelle

Creator

8mo ago

Ex-Finance Controller's startup raises $1.62M

Hi everyone,

Good Morning 🎉

It's been a few days since we last connected, and let me tell you, this week has been all about two focus:

- Helping each one of you build meaningful connections for business growth.

- Figuring out a sustainable/scalable revenue model for The Finance Story, so we can add more value while making money!

We spoke to over 100 finance professionals, gathering their insights on how to make networking truly impactful.

We also turned our attention to connecting with CPA firms in the US and UK to organize an exciting networking event.

Can't wait to see where this takes us!

Also, there are 82 days left until January 1st, 2025!!!

Mr. Ratan Tata

(Pic courtesy: Internet)

Yesterday, LinkedIn was overflowing with inspiring stories about Mr Ratan Tata.

What a legacy he has built!

Some friends in Mumbai even shared photos of the crowds, where people from all walks of life stood together to pay their respects.

So much to learn from one remarkable individual!

Ex-Mensa Brands Controller's startup raises $1.62M seed round

ZenStatement is an AI-powered finance automation and cashflow management startup, Founded by Sourabh Nolkha, a CA, and Ankit Narsariaa an Engineer.

The Bangalore-based budding startup has recently raised $1.62M in Seed Round funding.

In a conversation with The Finance Story, Sourabh estimates the market opportunity to be around $1 billion in India alone and $50 billion globally.

Who are the investors?

- Investment led by 3One4 Capital and Boldcap VC.

- Participation from Dynamis Ventures and Atrium Angels.

- Notable investors include Michael Boyd, former Global Treasury Head at Apple.

Industry veterans backing the startup

- Chetan Venugopal, Founder of Pierien Services.

- Ankit Nagori, Founder of EatFit.

FYI: Sourabh attended our Bangalore event in May'24 and so even more excited when I heard this news!!!

You can read his entire journey here.

LinkedIn Update: Going to Jail

Ryan Salame, former co-CEO of FTX Digital Markets and Sam Bankman-Fried ally - begins a 7.5-year prison term.

Why? For making unlawful campaign contributions and operating an unlicensed money-transmitting business.

And guess what - he updated his LinkedIn to reflect his new situation:

“I’m happy to share that I’m starting a new position as an inmate at FCI Cumberland. 😄🚔”

Sam Bankman-Fried, the disgraced founder of FTX, has been sentenced to 25 years in prison for orchestrating one of the largest financial frauds in history, stealing $8 billion from customers.

601 Chartered Accountants Under Investigation for Professional Misconduct

Approximately 601 Chartered Accountants (CAs) are under investigation for professional misconduct, as per the 75th Annual Report of the Institute of Chartered Accountants of India (ICAI).

This was first reported by TaxScan.

Over 40% of the ICAI's investigations result in findings of misconduct or lapses by the CA or the CA firm involved.

Punishments Issued

Professional misconduct cases are handled by two key bodies at the ICAI:

- Board of Discipline

- Disciplinary Committee

Punishments:

- Board of Discipline issued punishments in 63 cases.

- Disciplinary Committee imposed penalties in 142 cases.

As of now, 368 cases of professional misconduct are still pending before the ICAI's disciplinary bodies.

Penalties for Misconduct: The ICAI's maximum penalties include a lifetime suspension from membership and a fine of ₹5 lakh against erring CAs.

As per Financial Express,

- In FY23, the ICAI considered 500 cases of prima facie violations. However, hearings were concluded in only 152 cases.

- Since 2007, about 2,650 cases have been referred for inquiry with 40.7% resulting in punishment, totaling 1,080 CAs penalized.

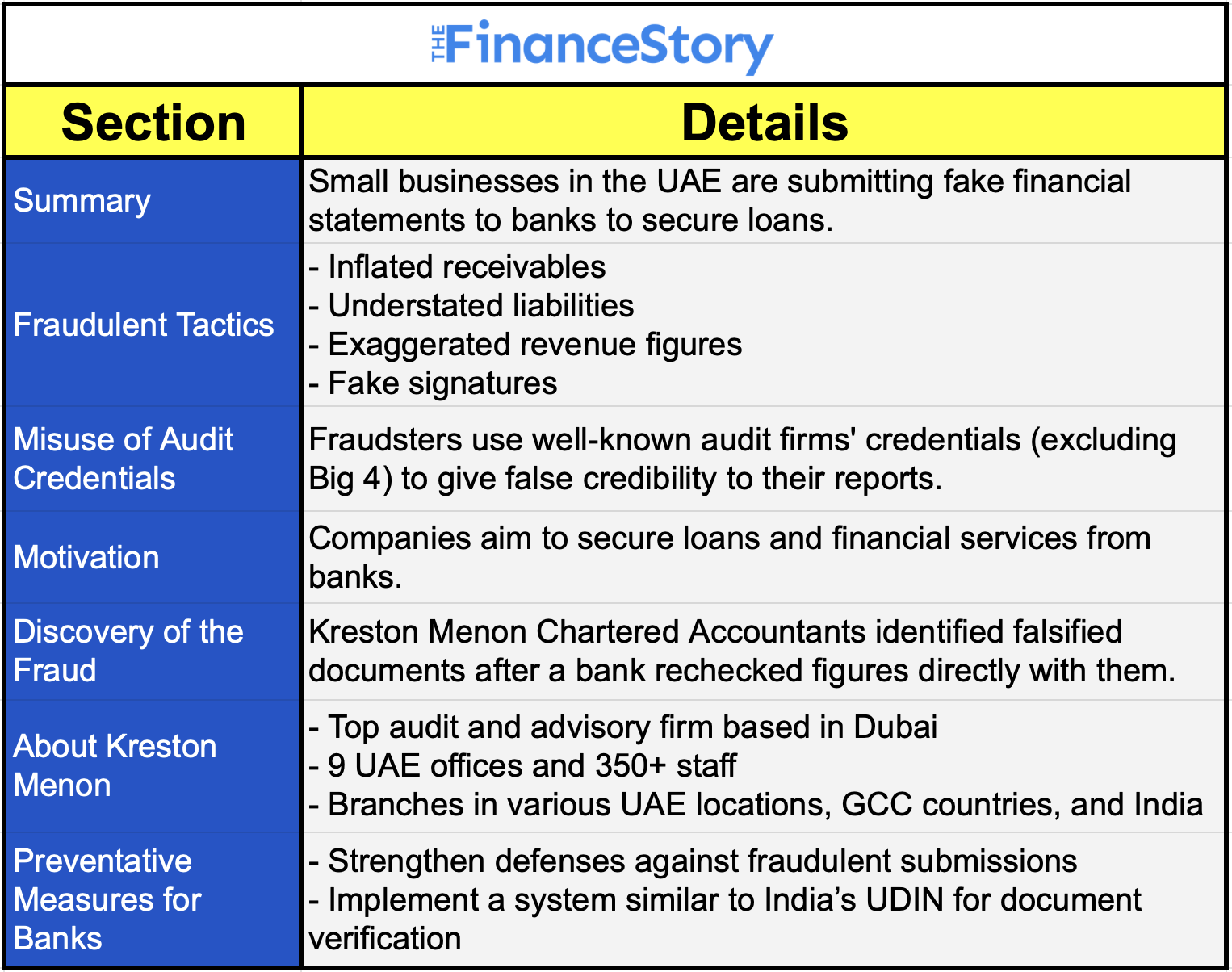

Fake financial reports used by UAE companies to raise money.

- The UAE banking sector is facing serious threats!

- Some small businesses are submitting fake financial statements to secure loans.

- Fraudsters are misusing the credentials of reputable audit firms to pull off these scams.

- Here’s the breakdown.

UAE is rewriting its tax playbook to attract more businesses

- The country is introducing new Value Added Tax (VAT) laws that simplify compliance.

- These changes underscore the nation's focus on growth, transparency, and opportunity.

UAE's new tax reforms

The UAE has rolled out new Value Added Tax (VAT) laws in a bold move to attract more businesses and enhance its investment climate.

The UAE Ministry of Finance has approved Decision No. 100 of 2024.

This decision introduces significant updates to the Executive Regulations of Federal Decree-Law No. 8 of 2017 on VAT.

Younis Haji Al Khoori, Undersecretary of the Ministry of Finance said,

“These amendments are designed to simplify processes for taxpayers.”

We are committed to enhancing the UAE’s business environment and minimizing misunderstandings or incorrect applications of the law."

The Finance Story will invite Tax Leaders in the UAE to share insights on this. Will update you.

BDO Accused Of Stealing, Lose High-Profile Clients Like Jay Z

BDO, the 5th largest accounting firm, faces a scandal as it loses its rich and famous clients, including Jay-Z and Megan Thee Stallion.

The reason? Allegations that BDO employees have stolen over $100,000 from clients' accounts.

This isn't BDO's first brush with controversy. Read here.

That's it for today!!!

We’re excited to announce our Fireside Chats 🔥, where you can choose to attend any session for just INR 300. Stay tuned for more details! 📢

The Finance Story Team

This post is part of a community

On WhatsApp

923 Members

Free

Hosted by

Chantelle